In the early days of PPP, there was chaos and confusion surrounding the program. An avalanche of questions came in: “Would the money run out?” “How do I get my loan submitted in time?!” and “I’m not a customer of yours but can I get the PPP loan through you?” Many businesses couldn’t find a bank to process their loan, and numerous companies went weeks or months without funding. Our bank seized this opportunity to make quick decisions in the face of uncertainty and desperation.

We began accepting applications as soon as the program opened on April 3. The program ran smoothly at first, but we eventually ran into trouble. Our online application portal was shut down within 48 hours due to technology outages caused by overwhelming loan volume at the SBA. Not wanting to leave our customers in a lurch, we began processing every loan manually. Our lending staff worked late nights and weekends to ensure that every loan was funded as quickly as possible.

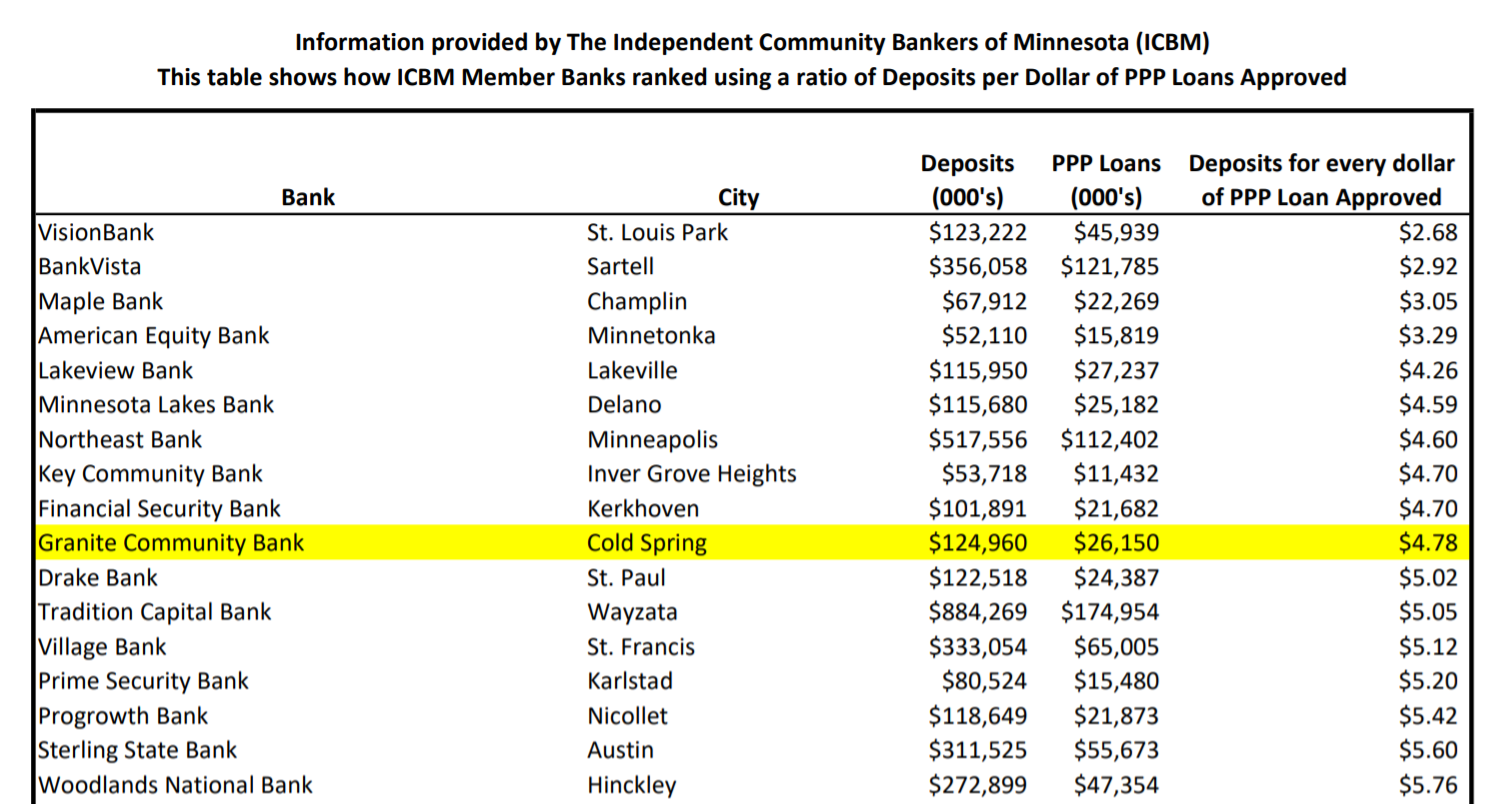

In business, it’s rare to see competitors turn away their own customers, but during those crazy weeks we encountered numerous businesses that were shut-out by the large banks. This presented a great opportunity for community banks like ours to step in and fill the void, and that’s exactly what we did. More than 1/3 of our PPP loans went to new customers of the bank. In total we funded approximately $26.5 million PPP loans, which was nearly ¼ the size of our bank at the time!

Our efforts were recognized by the Independent Community Bankers of Minnesota (ICBM), as we were one of the top banks in the state, measuring the amount of PPP loans compared to the bank’s size.

In hindsight, there are 3 things that made us successful with the first round of PPP.

- First, we were responsive to unrelenting questions about the program; we digested the constant rule changes and provided guidance to our customers by returning calls and emails within minutes, not days or weeks.

- Second, we displayed a willingness to lend to any eligible business. We viewed this as a responsibility to our community and an opportunity to build new relationships. This is in stark contrast to larger banks, which only lent to their largest, most profitable customers.

- Third, we were adaptive to the constant changes that were thrown at us. The rules changed daily and SBA technology shortages happened frequently – oh, and there’s the pandemic and social distancing to account for too.

As the 2nd Round of PPP draws near, we will apply the same mentality as round 1. We will work with ANY eligible small business to process their application, and are proud to do so. There will undoubtedly be unexpected hurdles, but it is with these challenges that GCB thrives best. We punched above our weight in Round 1 and will continue to do so in Round 2.

Ready to Apply for PPP Round 2 Funding?

Jacob Reiter

Jacob has been leading GCB’s PPP lending program, working with business owners and entrepreneurs to secure funding to keep their businesses functioning during the pandemic. Questions about PPP Funding?